House Republicans are pushing for legislation that would repeal the federal excise tax on indoor tanning services, which has been in place under the Affordable Care Act (ACA) since 2010.

On Monday, the House Ways and Means Committee released a draft of an expansive tax and spending package dubbed “One Big, Beautiful Bill.” One proposal calls for repealing the excise tax on indoor tanning services, which was originally implemented to help fund the ACA and discourage the use of indoor tanning.

Why It Matters

According to the Centers for Disease Control and Prevention (CDC), tanning beds significantly raise the risk of melanoma, the deadliest form of skin cancer. Proponents of the repeal argue that the tax disproportionately affects small businesses that provide tanning services and unfairly targets the tanning industry compared to similar services that are not taxed.

What To Know

Under the current law, indoor tanning services are defined as any service using equipment that incorporates ultraviolet (UV) lamps intended for skin tanning. The 10 percent excise tax is applied to the total cost of these services.

If the proposed legislation passes, the repeal will take effect immediately upon enactment.

The IRS notes that the tax applies to any indoor tanning service, including those offered at fitness centers and other facilities, unless specifically exempted. Some small business owners have criticized the tax, arguing that it has led to declining revenues and increased financial strain.

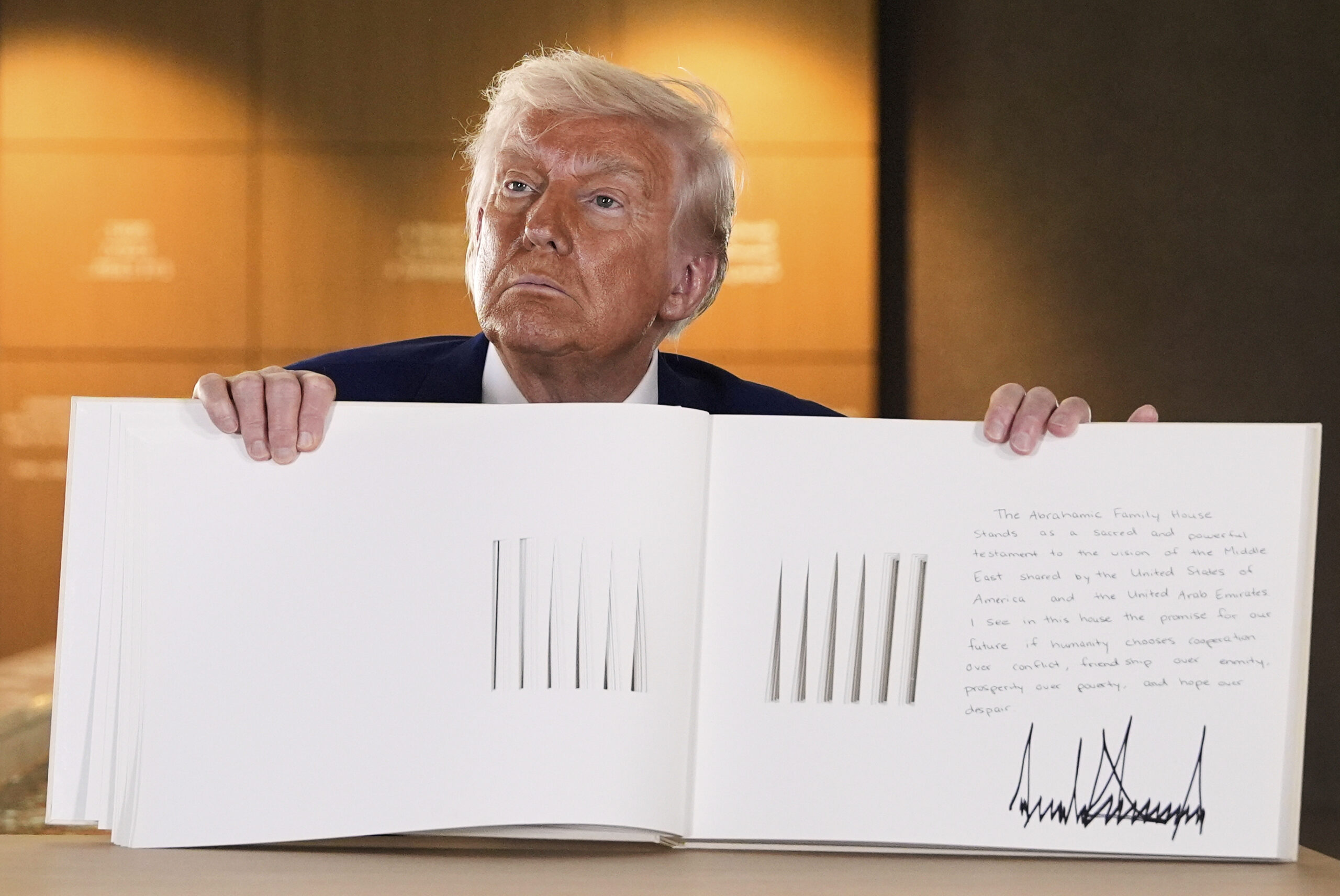

Alex Brandon/AP

According to a 2015 report from the Tax Foundation, when the tax came into effect on July 1, 2010, it was originally expected to raise $2.7 billion over 10 years. The Joint Committee on Taxation revised the projection down to $1.5 billion in 2012 because of lower-than-expected compliance and reduced demand for tanning services.

The think tank said the tax brought in $92 million in 2014, far below the $300 million originally anticipated for that year. According to the Tax Foundation, compliance was a challenge, with 11,000 out of an estimated 25,000 tanning businesses paying the tax quarterly in 2011.

Additionally, the exclusion of gyms and fitness centers from the tax reduced the tax base, disproportionately affecting smaller, stand-alone tanning salons.

The unintended economic consequences of the tax included a significant number of tanning salons going out of business and higher loan default rates among tanning businesses in states such as Florida.

The measure to repeal the federal excise tax on indoor tanning services is part of an expansive tax and spending package dubbed “One Big, Beautiful Bill. ” The bill also includes the elimination of taxes on overtime, loan interest for American-made cars, and Social Security. The tax cuts in the bill are estimated to cost over $5 trillion.

In addition to tax reforms, the bill proposes significant changes to social programs. Medicaid and the Supplemental Nutrition Assistance Program (SNAP) would see stricter work requirements and cost shifts to states, potentially leading to millions losing health coverage. The legislation also includes provisions to defund Planned Parenthood and repeal taxes on gun silencers.

On the education front, the bill aims to overhaul student loan repayment plans, impose taxes on large university endowments, and expand fossil fuel extraction on public lands. It also introduces “MAGA” savings accounts for newborns

Defense and border security are also focal points, with the bill allocating billions to revive Trump’s border wall, increase deportations, and fund a new missile defense system dubbed the “Golden Dome.”

What People Are Saying

Steven Rattner, former head of the Presidential Task Force on the Auto Industry, on X (formerly Twitter): “Among the more obscure features of the House bill is the repeal of tanning salon taxes. Can’t get more MAGA than that.”

Wendy Sherman, former deputy secretary of state, on X: “Tax universities more, wipe out taxes on tanning salons… Really?!”

What Happens Next

The bill, which the House Ways and Means Committee approved on Wednesday, could see a vote in the House as early as next week.

But while the bill has advanced through several House committees, its passage remains uncertain due to internal Republican divisions and anticipated resistance in the Senate.

Members of the conservative Freedom Caucus are demanding deeper cuts to Medicaid and the immediate implementation of work requirements for aid recipients, rather than the delayed start proposed in the bill. Simultaneously, moderate Republicans from high-tax states, such as New York, are advocating for a more substantial increase in the state and local tax (SALT) deduction cap. The current proposal to raise the cap from $10,000 to $30,000 is deemed insufficient by these lawmakers, who argue for a higher threshold to benefit their constituents.

Even if the bill passes the House, it faces additional hurdles in the Senate. Some Senate Republicans have already expressed skepticism about the bill’s provisions. Senator Ron Johnson of Wisconsin referred to the House budget plan as a “sad joke,” while Senator Rand Paul of Kentucky criticized the spending cuts as “wimpy” and “anemic.”