As the country grapples with its first economic contraction in three years, a new map showcases the sharp divide in how each state’s economy is weathering the 2025 downturn.

According to data released by the Bureau of Economic Analysis (BEA) on Friday, real gross domestic product (GDP) decreased in 39 states in the first quarter of 2025. This comes a day after the Commerce Department reported that the U.S. economy had shrank by an annual pace of 0.5 percent from January through March, worse than the previously estimated decline of 0.2 percent for the quarter and a reversal from the 2.4 percent growth seen at the end of 2024.

Why It Matters

The contraction in America’s GDP last quarter—the first contraction since early 2022—comes as President Donald Trump‘s trade agenda continues to weigh on economic activity by business and consumers. As shown in Commerce Department data, the most recent decline was heavily impacted by a 38 percent surge in imports, as businesses and households rushed to front-load their inventories before Trump’s tariffs took hold.

What To Know

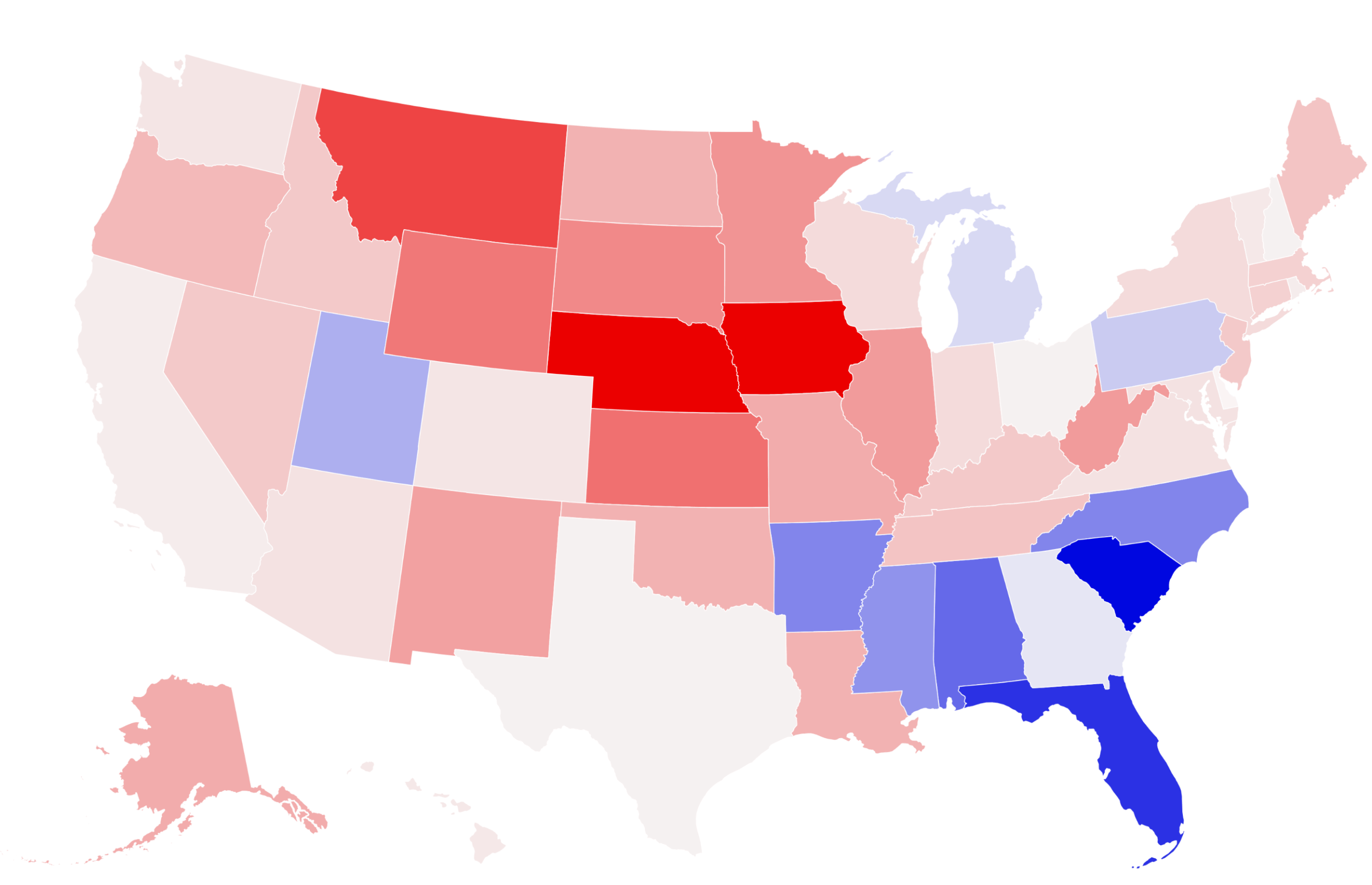

The map below, drawn using the BEA’s latest data, shows the change in each state’s inflation-adjusted GDP in the first quarter of 2025.

Growth ranges from a rate of 1.7 percent in South Carolina to -6.1 percent in Iowa and Nebraska. California, the nation’s economic powerhouse which recently overtook Japan to become the world’s fourth-largest economy, saw GDP contract by 0.2 percent.

On Thursday, the BEA reported that real GDP for the U.S. had decreased at an annual rate of 0.5 percent, the first decline since the first quarter of 2022. The agency noted that GDP dropped in 16 of the 23 recorded industry groups, with finance and insurance; agriculture, forestry, fishing and hunting; and wholesale trade the leading contributors to the decline.

The 0.5 percent decline was revised down from previous estimates, which the Bureau said reflected “downward revisions to consumer spending and exports,” only partly offset by imports coming in lower than expected. However, data still showed imports surging 37.9 percent in the quarter. The BEA noted that many of the declines were matched by upturns in investment, with gross private domestic investment up 23.8 percent.

What People Are Saying

White House Trade Advisor Peter Navarro, following the April estimate of a 0.3-percent GDP decline, told CNBC: “That’s the best negative print I have ever seen in my life.

“We had a 22 percent increase in domestic investment. That is off the charts when you strip out inventories and the negative effects of the surge in imports because of the tariffs, you had 3 percent growth.”

Bill Adams, chief economist for Comerica Bank, in comments shared with Newsweek following the latest GDP estimates, said that real GDP “likely rebounded” in the second quarter, but that this was “more due to a big drop in imports after tariff frontrunning than a pickup in domestic activity.

“Growth will likely hold below trend in the second half of the year, then gain traction in 2026 as income tax cuts offset tariff tax hikes.”

What Happens Next

The U.S. economy is expected to return to growth in the second quarter, given the outsized impact of imports in the first quarter. Forecasters surveyed by the Federal Reserve Bank of Philadelphia in May anticipate real GDP to increase 1.4 percent in 2025, though that’s down 1.0 percentage points from the same survey in February.