Amid an aging U.S. population and heightened economic uncertainty, new federal data reveals a decline in the number of Americans receiving Supplemental Security Income (SSI)—with some states seeing larger proportional decreases than others.

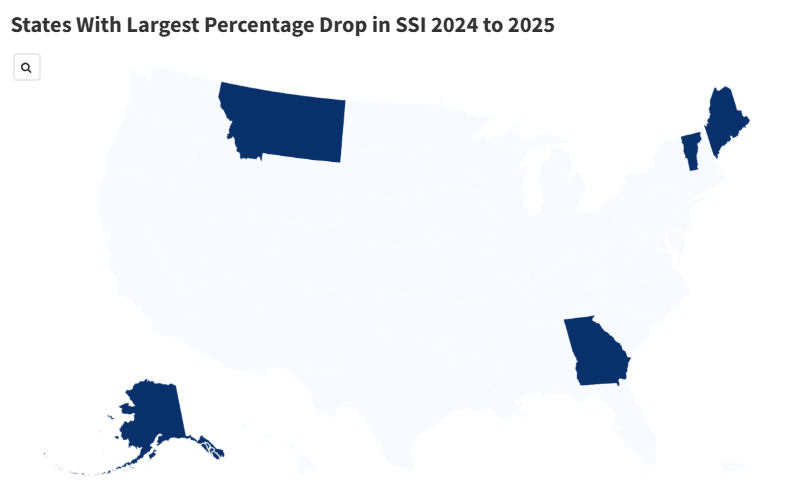

While populous states like California and New York showed substantial declines in total beneficiaries, smaller states such as Alaska and Maine experienced the most significant percentage drops, painting a complex picture of how the program’s reach is evolving across the nation.

Why It Matters

The SSI program provides essential support to low-income people who are either over the age of 65 or have a disability and fluctuations in enrollment can reflect broader socioeconomic and demographic shifts.

Experts point to rising living costs and evolving workplace accessibility as key forces reshaping the program’s utilization.

What to Know

According to federal data analyzed from February 2024 to February 2025, Alaska led the country with a 3.93 percent drop in SSI recipients, falling from 10,974 to 10,542 individuals. Maine followed with a 2.2 percent decrease, while Montana, Vermont, and Georgia each saw declines of more than 1.4 percent.

In raw numbers, Georgia’s reduction of 3,643 recipients was among the largest, highlighting how population size still contributes significantly to the overall impact. California, despite only seeing a 0.12 percent drop, lost nearly 1,400 recipients—one of the highest total changes due to its large SSI population base.

Nationally, the total number of SSI beneficiaries fell from 7.417 million in February 2024 to 7.414 million by February 2025, marking a reduction of approximately 300,000 people or a 0.4 percent decrease, according to the Social Security Administration (SSA).

While fewer people are receiving SSI benefits nationally in February 2025 than in 2024, the amount being paid out has increased by over $195 million, equivalent to a 3.6 percent increase.

Maine, which saw a 2.2 percent decrease in recipients, is spending 0.9 percent more in payments. California, which saw a 0.12 percent drop in recipients, is spending 2.7 percent more in payments.

Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, previously told Newsweek people who are disabled may be joining the workforce more now than in prior years because of the rising cost of living and employers are making more accommodations for people with disabilities, making it easier for them to work.

It’s all possible Americans’ ability to work for more years could be contributing to the drop in SSI recipients.

“Improved healthcare and lifestyle changes mean people aren’t just living longer—they’re staying professionally active longer,” Michael Ryan, a finance expert and founder of michaelryanmoney.com, previously told Newsweek.

VALERIE MACON/AFP via Getty Images

What People Are Saying

Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek: “Interestingly enough, there aren’t as many similarities as you would expect in the decline of SSI enrollment in some states versus others. States where the median incomes are higher like Maine and Vermont are bundled in with lower incomes like West Virginia and Alabama. And yet, despite the average income discrepancies, the one unifying theme has been more individuals attempting to find work to meet rising costs, regardless of condition, and thus not being eligible for participation. Meanwhile, states like Virginia that are reeling from the recent string of federal and private sector layoffs saw an uptick in those applying.”

What Happens Next

Moving ahead in 2025, Thompson said many of his clients are worried about President Donald Trump‘s impact on benefits.

“They’re either worried about insolvency or afraid the administration might somehow take the benefit away,” Thompson said. “Whether or not that’s grounded in reality, the fear is very real — and that alone could drive up the number of people filing early.”