State data on unemployment paints an uneven picture of the U.S. jobs market, with the number of claims rising in some area while falling in others.

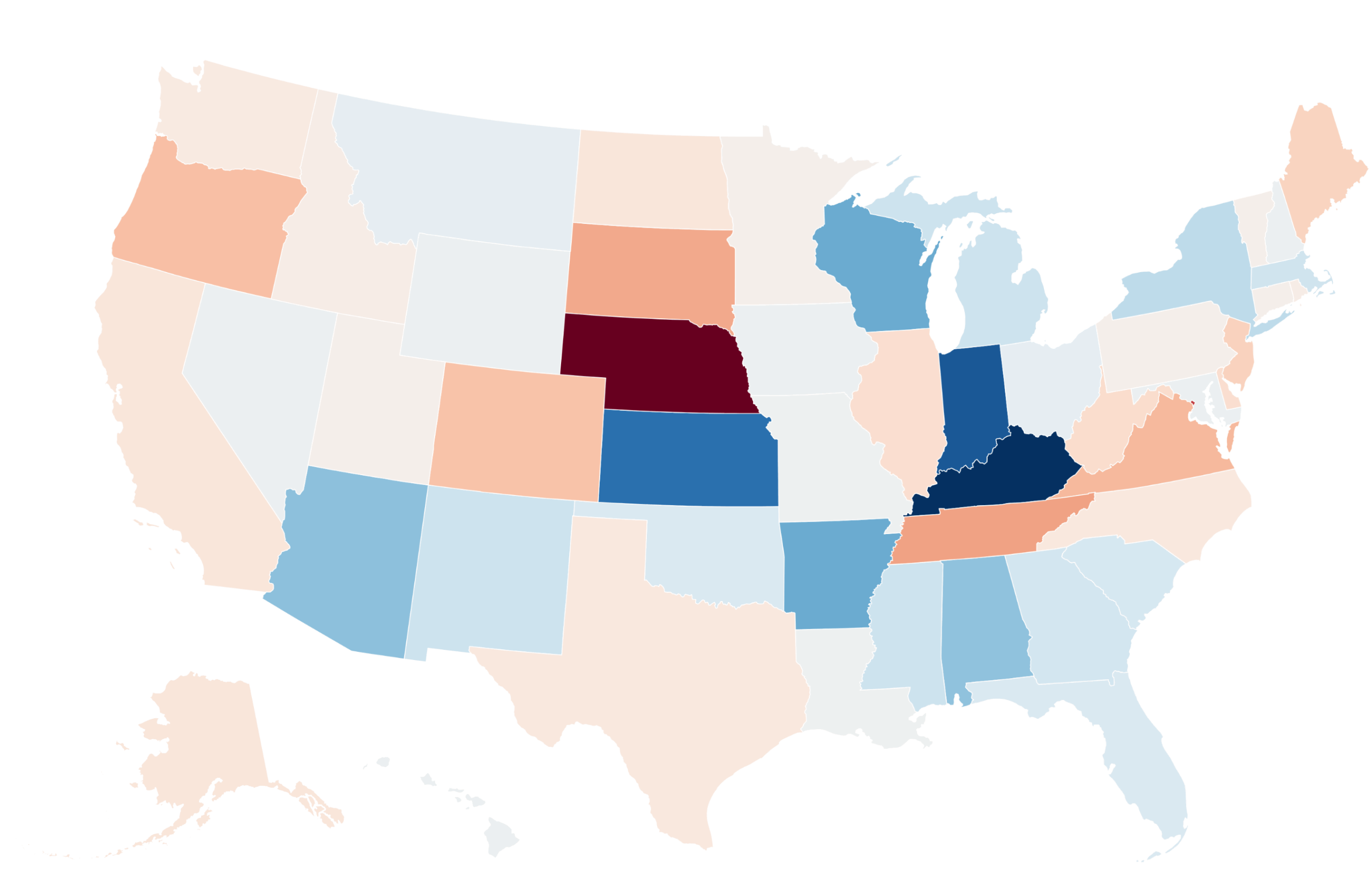

Using analysis from personal finance website WalletHub, Newsweek mapped the states with the highest number of unemployment insurance claims, noting how these have changed in recent weeks and over the past year.

Why It Matters

Unemployment claims—particularly initial claims of those filing for unemployment insurance for the first time—are a closely monitored gauge for the health of the U.S. labor market. These data points have taken on added significance in 2025, a year marked by mass layoffs in the private sector, particularly tech and retail, as well as in the federal government.

While unemployment has remained steady—at 4.1 percent for June—the jobs market remains a key area of concern that can inform decisions on fiscal policy.

Joe Raedle/Getty Images

What To Know

According to WalletHub, citing Labor Department data, new unemployment claims decreased by 2.2 percent on June 30 compared to the week of June 23.

The personal finance website ranked how each state is performing in this regard, based on recent changes, year-on-year increases or decreases, as well as the number of unemployment insurance claimants per 100,000 people in the labor force. The results of its analysis can be seen below.

In terms of states that saw the biggest drop over the period WalletHub examined, New Hampshire was at the top, with claims dropping by 49 percent from the previous week. Compared to the corresponding week last year, however, the number of new unemployment claims has fallen only 3.5 percent.

Meanwhile, claims in Washington, D.C.—home to most of the nation’s federal government employees—rose by 23 percent, and are now 73 percent higher than a year prior. D.C. is second only to Nebraska in this category, where claims have doubled year-over-year.

In terms of claims per capita, Michigan stands out, with now 307 unemployment claims per 100,000 people in its labor force. It is closely followed by New Jersey and North Dakota at 306 and 305, respectively.

On the other end, South Dakota has only 43 unemployment insurance claimants per 100,000, followed by New Hampshire and Florida, both with 54.

On Thursday, the Department of Labor released its latest weekly tally of initial jobless claims, revealing that these fell by 5,000 to 227,000 for the week ended July 5, despite analyst forecasts signaling an increase. The drop brought the figure to a seven-week low.

While initial claims decreased, continuing claims—those who are continuing to receive unemployment insurance—climbed to 1.97 million for the week ended June 28 from 1.96 million a week earlier.

Data for June released by the Bureau of Labor Statistics a week prior found that the economy had added 147,000 jobs in the month, thanks largely to gains in health care and state government. This was up from 144,000 the previous month and ahead of the expected 100,000.

What People Are Saying

Nancy Vanden Houten, lead U.S. economist at Oxford Economics, in comments shared with Newsweek following Thursday’s release: “The latest jobless claims data were influenced by seasonal quirks, including the summer shutdown of auto plants, but remain consistent with a labor market characterized by both a slow pace of hiring and relatively few private-sector layoffs. For now, the labor market is healthy enough to allow the Federal Reserve to keep interest rates unchanged as it assesses the impact of tariffs on inflation.”

“Claims for benefits by federal employees remain low but that will likely change soon,” she added. “The Supreme Court earlier this week ruled that the Trump administration may proceed with layoffs of federal workers while legal challenges continue.”

What Happens Next?

The next meeting of the Federal Reserve’s Open Market Committee—the central bank’s main policy-making and rate-setting body—will take place at the end of this month.

Amid fears over resurgent inflation, the Fed has held off on cutting interest rates, despite major political pressure to do so. Analysts believe the health of the U.S. jobs market will be a key determinant in whether and when it finally decides to bring down borrowing costs.