Home sale cancellations surged across the country in April, as buyers either got cold feet amid growing economic uncertainty or saw a better opportunity on a market that is facing quickly rising inventory levels.

In no other U.S. metropolitan area, buyers walked out of pending home purchasing deals as much as in Atlanta, Georgia, where one in five sales fell through, according to a recent Redfin report.

Why It Matters

While housing inventory levels have risen significantly across the U.S. over the past year, easing the shortage that contributed to skyrocketing prices since the pandemic, buyers are still struggling with historically high mortgage rates and rising costs.

Americans trying to buy a home this year are facing more options on the market, but they are not necessarily in a better financial position to purchase them. On top of that, volatility in the markets and widespread fears of a looming recession are pushing buyers on the side of caution, making them think twice about whether they want to make such a big purchase this year.

As a result of these dynamics, home sales are dwindling and cancellations are rising, even as inventory is finally growing.

What To Know

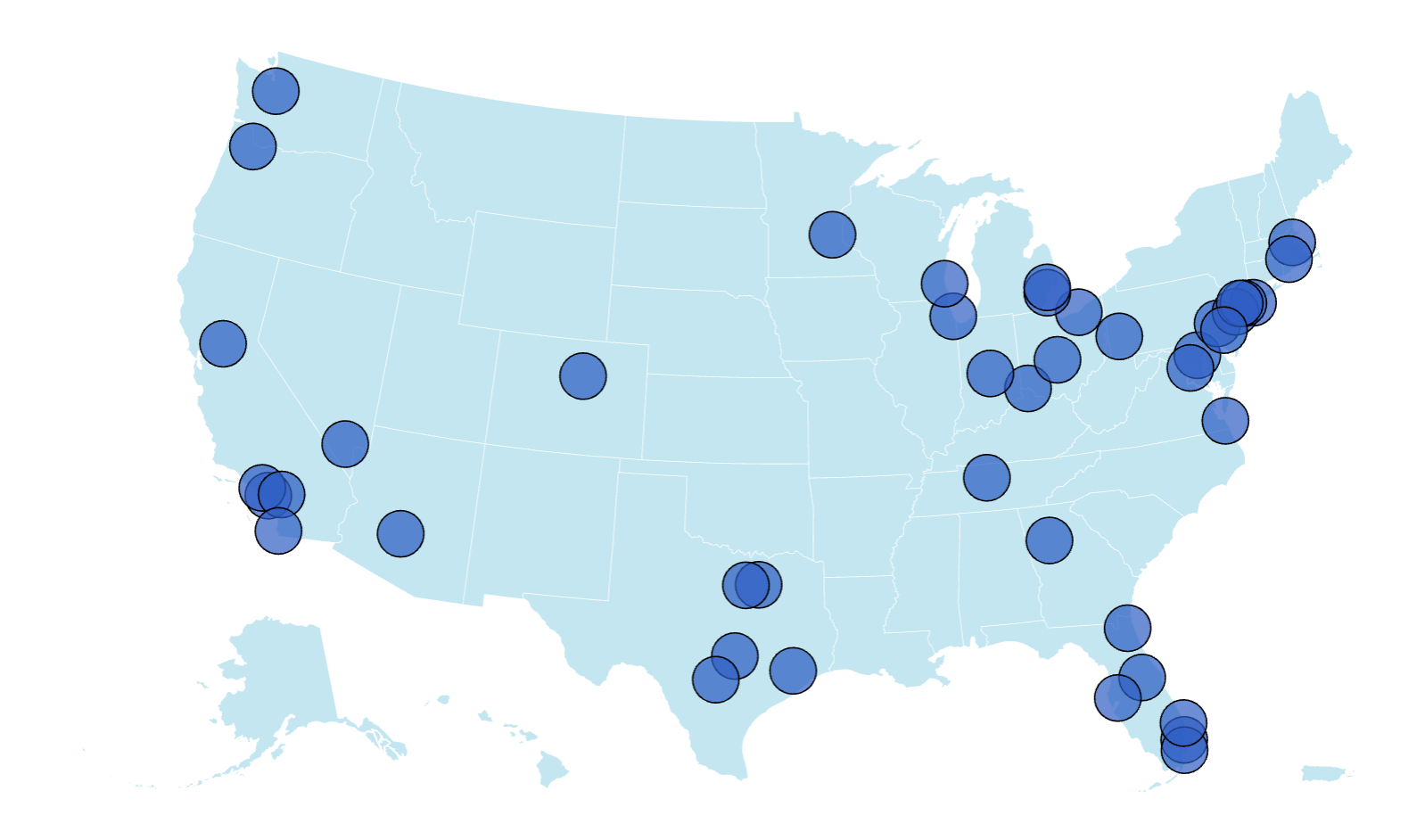

At the national level, roughly 56,000 home sales were canceled in April, equal to 14.3 percent of all purchase agreements that month, up from 13.5 percent a year earlier.

In Atlanta, the metro that led the U.S. with the highest number of home sale cancellations in April, 20 percent of home-purchase agreements fell through, up from 17.6 percent last year.

“We suspect that since Atlanta has been an investor hotspot in recent years, this could be the impact of investors backing out of deals, which might account for part of this trend,” Redfin chief economist Daryl Fairweather told Newsweek.

Atlanta was followed by Orlando, Florida (19.4 percent), Tampa, Florida (19.1 percent), Riverside, California (19.1 percent) and Miami, Florida (18.9 percent). Rounding out the top 10 were more Florida and Texas cities, among others, including Fort Lauderdale, Florida (18.9 percent), Fort Worth, Texas (18.7 percent), Jacksonville, Florida (18.4 percent), and San Antonio, Texas (18.2 percent). Las Vegas, Nevada, was at 18.6 percent.

“In Florida and Texas, rising insurance costs are giving buyers pause,” Fairweather said. “Buyers often don’t know their insurance costs until after a deal goes pending, which can cause sticker shot or the inability to get insurance altogether.”

The biggest increases in home cancellations were reported in Anaheim, California (up 3.1 percentage points from a year earlier), Seattle, Washington (up 2.8 points), Milwaukee, Wisconsin (up 2.7 points), Los Angeles, California (up 2.6 points) and Nashville, Tennessee (up 2.6 points).

The lowest cancellations rates, on the other hand, were in Nassau County, New York, (4.8 percent), Boston, Massachusetts (8.1 percent), Montgomery County, Pennsylvania (8.1 percent), Minneapolis, Minnesota (8.4 percent), New York, New York (8.7 percent), Milwaukee, Wisconsin (9.2 percent), Seattle, Washington (9.8 percent), Newark, New Jersey (9.8 percent), Warren, Michigan (10.4 percent) and New Brunswick, New Jersey (10.5 percent).

“Demand for homes especially in more affordable Northeast metros has been stable,” Fairweather said.

“Even though there is economic uncertainty, there is still economic growth, and people want to own homes if they feel like they personally can afford it.”

What People Are Saying

Fairweather told Newsweek about the rise in home sale cancellations: “The economy is uncertain right now, and it’s causing buyers to get the jitters. Sometimes, sellers will offer concessions to get a deal to go through, but both parties can’t always see eye-to-eye on terms, which causes deals to fall apart.”

National Association of Realtors chief economist Lawrence Yun said of falling existing home sales in a statement shared with Newsweek: “Pent-up housing demand continues to grow, though not realized. Any meaningful decline in mortgage rates will help release this demand.”

What Happens Next

While the rise in home sale cancellations indicates that many American prospective homebuyers are still struggling, it also suggests that their negotiating power is increasing.

Experts said that much of the U.S.—with the exception of areas where the housing shortage is more acute, like the Northeast—is now a buyers’ market, meaning that they have the upper hand. Swooping in after a pending home sale has fallen through can be a great way to get a discount from a discouraged seller, Redfin realtors said.

Redfin