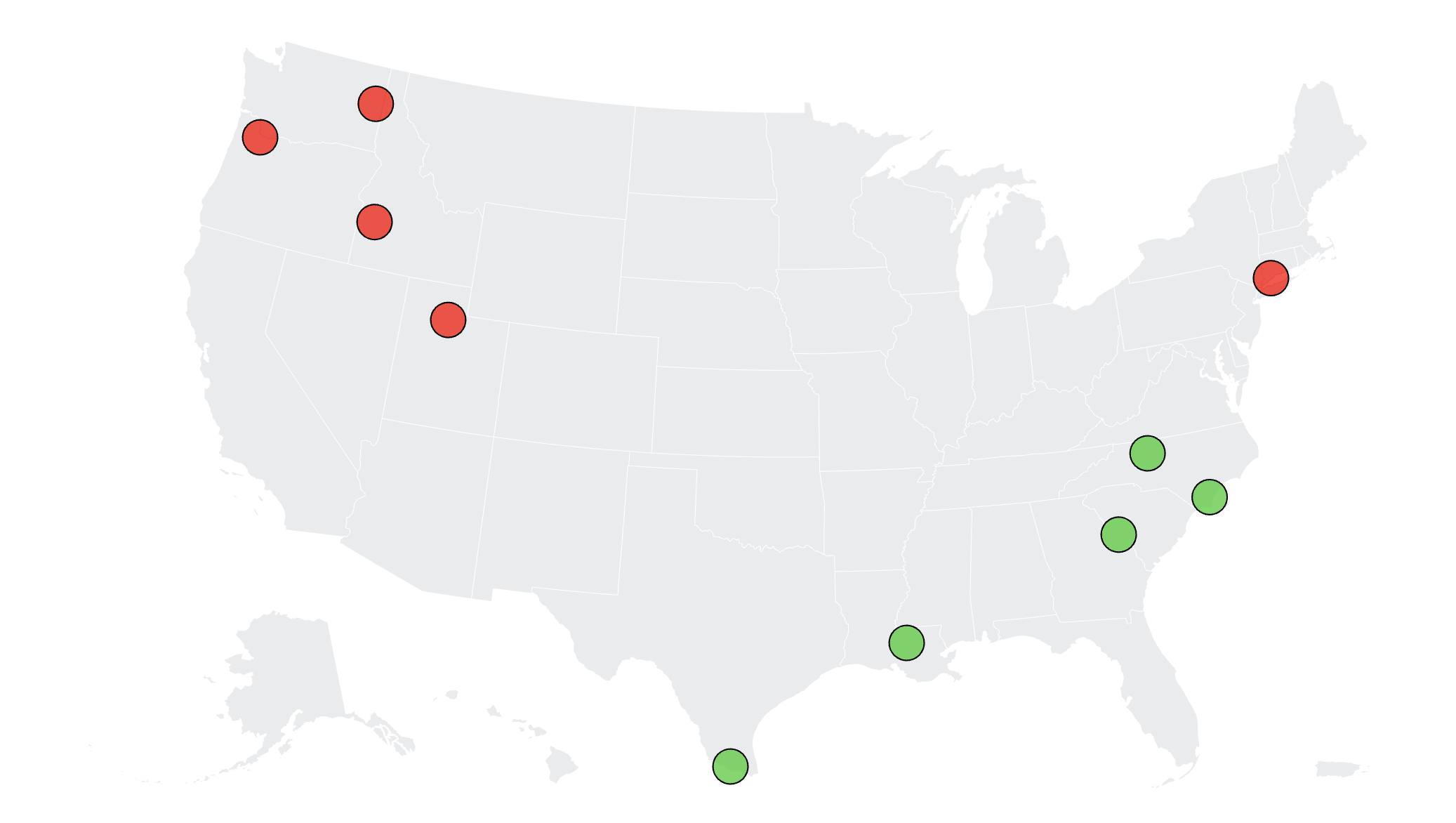

The housing affordability crisis is much worse in the north of the country than in the south, a new study by LendingTree reveals, with metropolitan areas in Texas, North Carolina, Louisiana and Georgia offering first-time homebuyers the best opportunity to step onto the property ladder this year.

Those hoping to buy a home in the Pacific Northwest, on the other hand, faced many more hurdles—including a lack of available housing and generally higher prices.

Why It Matters

The entire country is in the midst of a critical situation regarding housing affordability that has hit first-time homebuyers particularly hard, with historically elevated mortgage rates and rising costs keeping many on the sidelines of the market. While inventory is finally rising across the country, giving homebuyers more options and more negotiating power, prices are still rising at the national level and mortgage rates are still hovering around the 7-percent mark.

Prospective homebuyers, however, face a wildly different situation in the market depending on where they are trying to buy a property. Southern states like Florida and Texas, which experienced a boom during the pandemic, built more new homes than anywhere else in the country—and this surge in inventory is now adding downward pressure on prices. But in the Northeast and the Northwest, where the housing shortage is still acute, homebuyers are unlikely to see prices going down this year.

What To Know

Online consumer platform LendingTree analyzed vacancy rates, housing unit approvals, home value-to-income ratios and changes in those ratios for the 100 largest U.S. metros to determine where the housing crisis is worst and best.

According to these criteria, these are the five U.S. metros with the worst outlook in the country:

- Portland, Oregon

- Boise, Idaho

- Bridgeport, Connecticut

- Spokane, Washington

- Salt Lake City

And these are the five U.S. metros with the best housing outlook in the country:

- McAllen, Texas

- Wilmington, North Carolina

- Winston-Salem, North Carolina

- Baton Rouge, Louisiana

- Augusta, Georgia

The study’s findings show a clear divide between the north and the south of the country. Portland, which ranked the worst overall, had the fourth-lowest vacancy rate in the country (4.76 percent) and the 13th-highest home value-to-income ratio (5.57).

The median home value in Portland is $526,500, while the median household income is $94,573.

The former pandemic boomtown of Boise ranked second overall with the second-lowest vacancy rate in the country (4.56 percent) and the fourth-largest growth in its home value-to-income ratio, jumping 7.12 percent from 2022 to 2023.

“The vacancy rates in Portland and Boise are less than half of those in many other big metros,” LendingTree’s chief consumer finance analyst, Matt Schulz, said in the report.

“When that happens, prices rise, making things even more expensive. Unfortunately, this isn’t likely to change in many of the most troubled metros because the data shows that insufficient building is being done,” he added.

“That’s not the case in Boise, where new permits are among the highest in the nation, but it’s the case in Portland, Bridgeport and other metros with similar rankings. That doesn’t bode well for the near future.”

On the other side of the coin, southern cities are doing much better in terms of housing affordability. McAllen has the lowest home value-to-income ratio at 2.37, with the median home value at $124,000 and the median household income at $52,281. It also had the eighth-highest housing unit approvals, at 24.42 per 1,000 units.

The highest housing unit approvals in the entire country was reported in Wilmington, at 39.78 per 1,000 units, with the city ranking third overall for best housing crisis outlook. Wilmington also had the third-highest vacancy rate at 21.16 percent and the ninth-lowest change in its home value-to-income ratio, which grew just 1.51 percent between 2022 and 2023.

Many of the metros with the best outlooks have one thing in common, besides being in the South. They are “relatively low-income areas,” Schulz said. “Plus, Southern metros don’t tend to be as densely packed, especially compared to their Northeastern counterparts, meaning there’s more room to build and grow. More available property tends to mean lower costs.”

What People Are Saying

LendingTree analyst Matt Schulz said in a statement shared with Newsweek: “The cost of buying a home is outrageous in many places throughout this country. High prices and interest rates mixed with limited supply mean that in some of the nation’s biggest cities, homeownership is all but out of reach for many people.”

What Happens Next

While the South remains generally more affordable for first-time homebuyers, Schulz warned that some of the southern metros that have experienced a boom in recent years have also seen the biggest increases in home value-to-income ratios which priced locals out of the market.

The biggest increases were reported in Durham, North Carolina (up 8.6 percent between 2022 and 2023), Charlotte, North Carolina (up 7.2 percent), and Spokane, Washington (up 7.17 percent).

“Virtually all of the areas with the biggest increases are growing in a big way,” he said. “When people move into an area in droves, they can drive up housing values. They also tend to drive up incomes, though those may not rise quite as rapidly as housing values. I think that gap may continue to widen.”

LendingTree