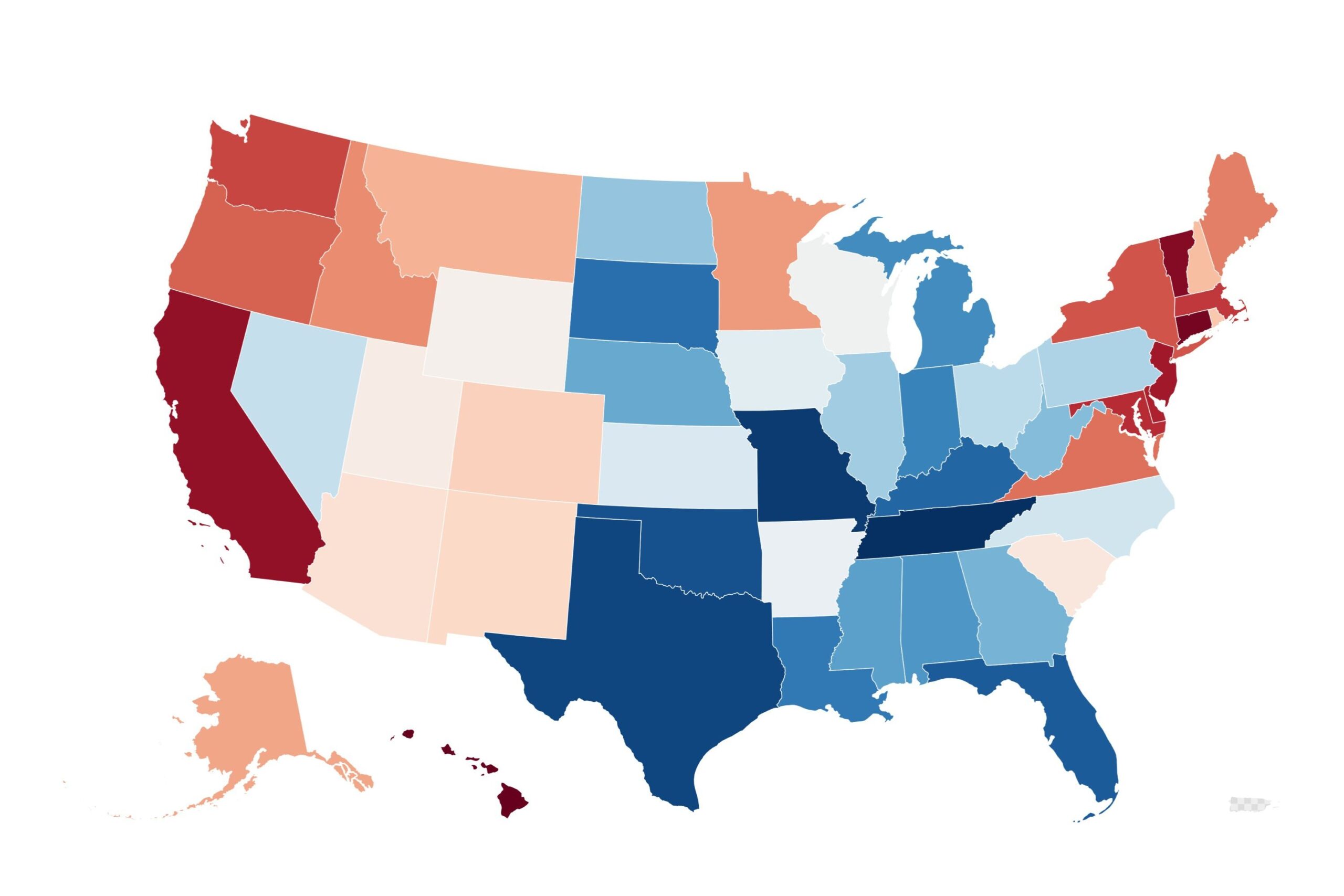

Newsweek has mapped the five easiest and five hardest U.S. states to save money in, based on a new study by Bankrate analyzing financial conditions across the nation.

The rankings consider state-level cost of living, tax burdens, employment growth, and average interest rates on savings accounts.

Why It Matters

Saving money remains a key financial challenge for many Americans, as inflation and housing costs continue to pose challenges for many.

Consumer confidence has also wavered amid concerns about economic stability.

What To Know

Tennessee topped the list as the easiest state to save money, while Hawaii ranked as the most difficult.

According to Bankrate’s study, the top five easiest states to save money in share three primary traits:

- Low tax burdens: State and local tax rates in these states ranged from 7.6 percent to 9.3 percent, all below the national median of 10.2 percent, based on figures from the Tax Foundation.

- Affordable living costs: Lower prices for housing, food, and transportation reduce daily expenses, freeing up more income for savings.

- Positive employment trends: Each of the top five states ranked in the top 20 for employment growth over the past five years, signaling a strong labor market.

These factors combined create an environment more conducive to saving. Here are the top five easiest and hardest states to save money, according to Bankrate:

Easiest States to Save Money

- Tennessee: With the third-lowest tax burden (7.6 percent) and strong job growth (6.2 percent over five years), Tennessee ranked first overall. The state also had one of the top five money market account (MMA) rates.

- Missouri: Missouri ranked high in local economy indicators, including a low cost of living, and placed well for deposit interest rates, despite a slightly higher tax burden at 9.3 percent.

- Texas: A strong labor market placed Texas second for employment growth. Although cost of living was average and savings yields were low, a favorable 8.6 percent tax rate helped secure its third-place ranking.

- Oklahoma: With the second-best cost of living and competitive MMA rates, Oklahoma offered residents broad advantages for saving.

- Florida: Robust employment gains (10.5 percent from 2019 to 2023) and increasing household incomes helped Florida earn fifth place, despite rising housing costs and a middling cost-of-living rank.

Hardest States to Save Money

- Hawaii: Topping the list as the most difficult state to save money, Hawaii faces high housing, food, and transportation costs. It also experienced negative employment growth, the report said.

- Connecticut: Burdened with one of the highest combined state and local tax rates, Connecticut also suffers from a slow-growing job market, according to report.

- Vermont: The report said that high cost of living and sluggish job growth also landed Vermont near the bottom.

- California: Despite a dynamic economy, California’s elevated cost of living and taxes make savings harder to accumulate, the report found.

- New Jersey: Like other Northeastern states, high taxes and living expenses make it difficult for residents to grow their savings.

What People Are Saying

Jay Ritter, with the University of Florida’s Warrington College of Business told Newsweek: “State taxes and the cost of living, especially housing costs, have the biggest impact on personal savings rates. Gainesville, where I live, with a population of about 200,000, has much lower taxes and housing costs than the New York metropolitan area or most of California, for instance.

“In general, areas that have had declining populations, such as Buffalo, New York, and many small towns across America, have seen housing prices decline in inflation-adjusted terms over long periods of time. In these areas, housing is relatively cheap, but has been a bad performer for homeowners to build wealth.”

Ritter added: “Some of the high-income states, such as Connecticut and New Jersey, have relatively high state income taxes and housing costs, but because of high incomes also have high savings rates. Florida and Texas have zero state income taxes, but Florida has a high proportion of retired people who are not saving, but instead are eating into some of their prior savings.

“So a better comparison would be to compare working people in the same occupation across states. When this comparison is done, low tax states such as Florida have higher savings rates.”

What Happens Next

As economic pressures persist, the disparity in savings potential across states may become an increasingly important factor for Americans considering relocation or financial planning.