California Governor Gavin Newsom has expanded the state’s tax incentives for film and television productions to woo them back to Hollywood.

Since the turn of the century, other U.S. states and foreign countries have offered financial incentives, including tax breaks, for projects to film there. This has led to an exodus of filming from California, where Hollywood is traditionally seen as the home of film and TV production.

States such as Louisiana, Georgia and New York, and international countries including the United Kingdom, Australia, Canada, Thailand, Croatia and Bulgaria have attracted major productions since overhauling their TV and film incentives. Given Hollywood’s sluggish performance at the box office, many studios look to save money wherever they can.

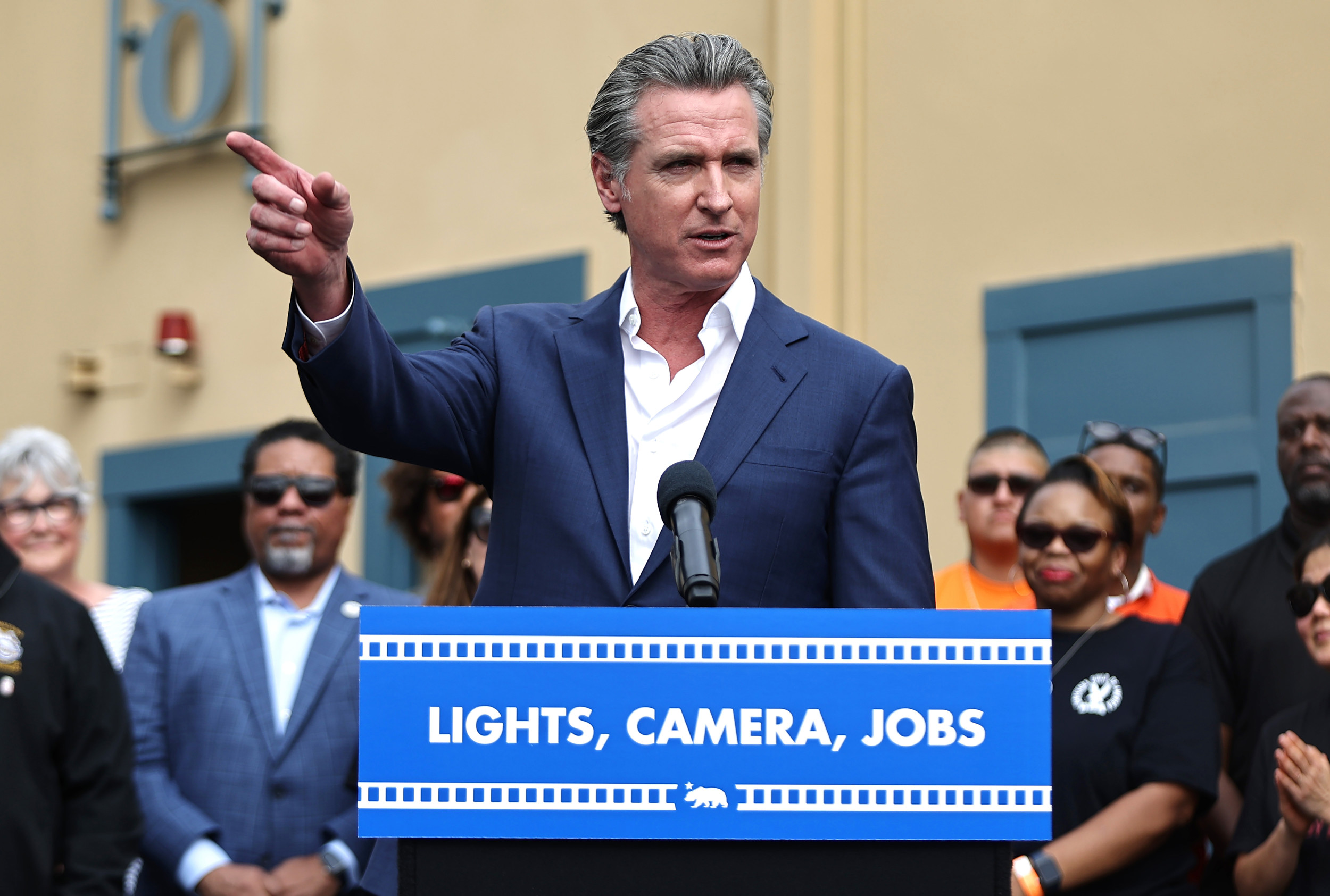

To attract productions back to California, Newsom announced an expansion of the state’s Film and Television Tax Credit Program to $750 million annually, up from the current $330 million.

“California is the entertainment capital of the world, rooted in decades of creativity, innovation, and unparalleled talent. Expanding this program will help keep production here at home, generate thousands of good-paying jobs, and strengthen the vital link between our communities and the state’s iconic film and TV industry,” Newsom said in a statement.

Newsweek reached out to Newsom for comment via email on Monday morning outside office hours.

According to data from the governor’s office, around 71 percent of productions that were not able to get a tax credit in California ended up moving to another state to complete the project, resulting in “significant economic losses” for California.

“We wanted to reconcile the stress that’s been building up here for, frankly, the better part of a decade,” Newsom said at a press conference on Sunday alongside Los Angeles Mayor Karen Bass and industry union leaders.

Mario Tama/Getty Images

Bass, who helped draft California’s original tax credit system when she served as speaker of the California State Assembly in 2009, said it was first created to help prop up the industry. The latest announcement would continue that support.

California’s tax credit program has generated $26 billion in economic activity for the state and supported more than 197,000 cast and crew jobs since it was first introduced 15 years ago.

“Hollywood is the cornerstone of this city and our economy and our message to the industry today is clear – we have your back,” Bass said in a statement.

The California legislature must first approve the tax credit expansion, which would come into effect on July 1, 2025.

Joe Chianese, SVP of Incentives at Entertainment Partners, said on The Town podcast with Puck editor Matthew Belloni that when projects are being put together, the question of filming location often comes down to money and how much can be saved. He added that productions can save up to tens of millions of dollars depending on where in the world and the type of project being made.

“When producers are thinking about where to go, they kind of look at it as a three-legged stool. They want infrastructure, they want crew, and they want incentives,” Chianese said.

Chianese added that because other areas offered tax incentives, their filmmaking infrastructure eventually developed to the point where they could make their own Hollywood-level films, ultimately creating more competition for American projects, especially at the box office.

“When production is leaving the U.S., we are training other countries to sort of make American-style movies,” he said, adding, “And I think that’s also the big risk…that these countries can make their own movies with their own movie stars and their own storylines. I feel that that could, over time, really impact the money that U.S. movies make.”