More than half of U.S. homes are declining in value, according to a recent report from Zillow, the largest share since 2012.

A study by the online real estate marketplace, released on Monday, found that 53 percent of all U.S. homes have seen their valuations drop compared to last year, with a nationwide average decline of 9.7 percent compared to their peak price.

Why It Matters

As Zillow writes in its report, “home value declines can be scary. For most homeowners, their house is their largest asset, and equity built over time is a major part of their long-term saving and retirement plans.”

The widespread declines reflect a slowdown in demand and reluctance among would-be buyers, itself driven by rising barriers to homeownership such as costs and elevated mortgage rates as well as broader financial pressures.

What To Know

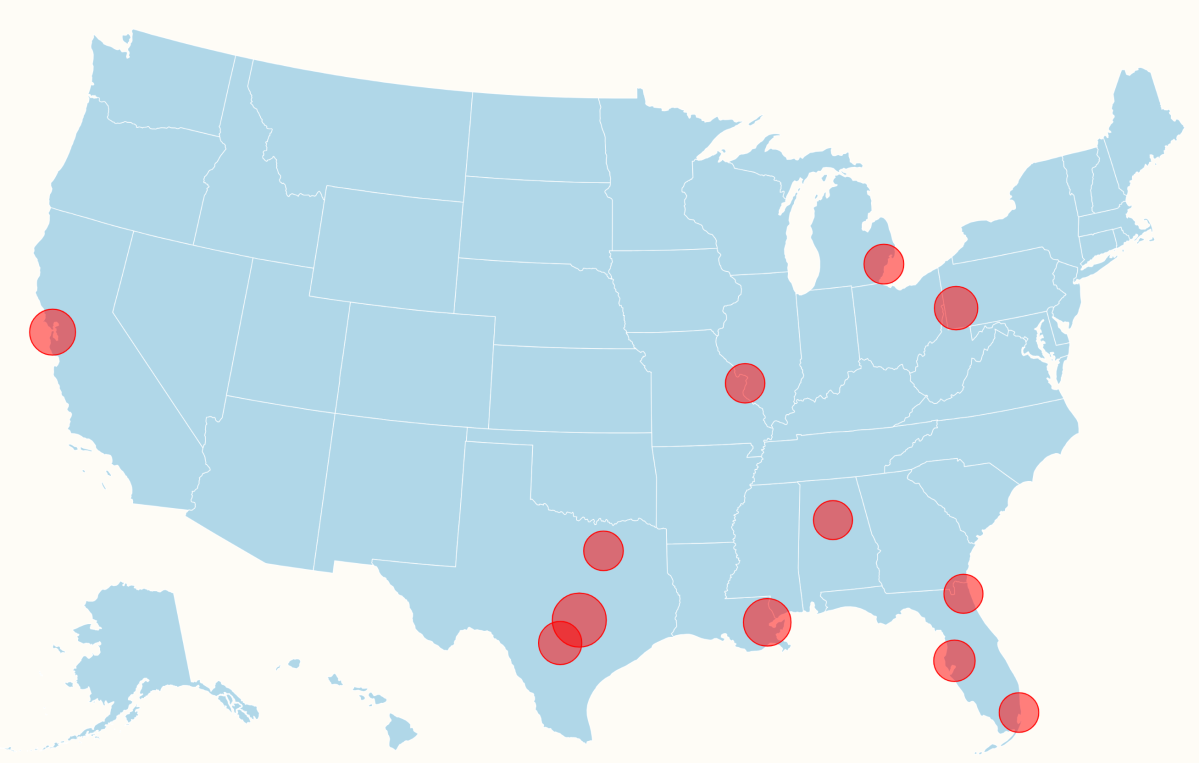

Zillow’s data shows that several metro areas have experienced home value declines far exceeding the national average.

Austin, Texas has seen the greatest drop, with home values falling an average of 20.5 percent compared to their peak, more than double the nationwide average. Austin is followed by New Orleans (15.9 percent) San Francisco (14.8 percent) and Pittsburgh (13.2 percent).

In terms of those that have seen the largest share of home valuations fall, many are areas which saw demand surge during the pandemic. These include Denver, where 91 percent of homes have dropped compared to their peak value, followed by 89 percent in Austin and 88 percent in Sacramento.

However, Zillow writes that “the vast majority of homeowners have plenty to feel good about.”

Home values are up by a median of 67 percent since their last sale nationwide, and only 4.1 percent of homes in October were valued lower than at their last sale—or sold for a loss—up from 2.4 percent in 2024 but well below the 11.2 percent level prior to the pandemic.

What People Are Saying

Treh Manhertz, senior economic researcher at Zillow, wrote: “Homeowners may feel rattled when they see their Zestimate drop,” referencing the firm’s proprietary system for measuring market value, “and it’s more common in today’s cooler market environment than in recent years.”

“But relatively few are selling at a loss,” he added. “Home values surged over the past six years, and the vast majority of homeowners still have significant equity. What we’re seeing now is a normalization, not a crash.”

Redfin Head of Economics Research Chen Zhao wrote in a recent report: “With demand still historically low, the slowdown in fresh supply and the shortage of buyers are largely offsetting each other. Fewer metros are seeing month-to-month price declines than they were over the summer, but that doesn’t signal a pickup in demand. Sales are still slow, and many buyers who don’t need to move are staying on the sidelines. The sellers who are listing now often need to move, but it’s hard to attract buyers in a market where affordability is stretched and uncertainty remains high.”

What Happens Next

While affordability issues continue to plague prospective buyers and low demand weighs on existing owners, experts are pointing to things such as easing mortgage rates as a sign that the housing market may be beginning to stabilize.