Home prices have surged across the U.S. in the first quarter of 2025 compared to the same period last year, with some unexpected cities leading the way with the steepest increases.

According to the National Association of Realtors (NAR), Syracuse, New York, recorded the largest annual home price growth in the country between January and March, with an 18 percent increase. The median home price in Syracuse reached $234,300—lower than the nationwide median average of $403,700.

Why It Matters

Syracuse, a city known for its affordable housing, has seen its housing inventory shrink dramatically since the pandemic. In early 2019, Syracuse typically had about 1,500 homes on the market. By the beginning of 2025, that number had dropped to 560, pushing prices higher amid increased competition.

The trend, which has been observed in other cities across the country, has placed homeownership out of reach for many Americans.

What To Know

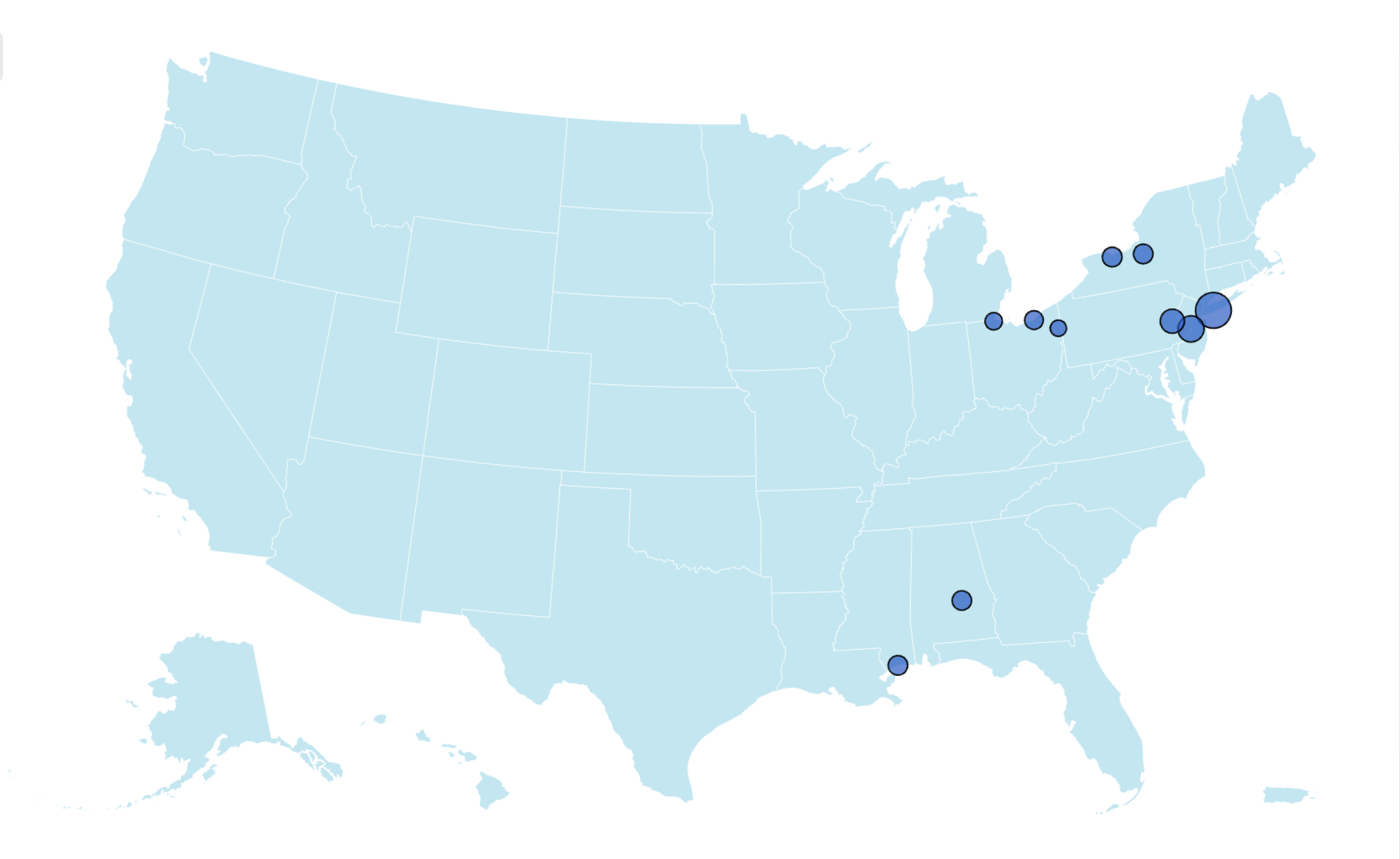

During the first quarter of 2025, home prices rose in 83 percent of the 228 metros tracked by NAR. While the share of markets with price growth has decreased slightly from the 89 percent seen in the previous quarter, most metro areas still saw significant increases.

Another city experiencing substantial price growth is Montgomery, Alabama, which reported a 16 percent year-over-year rise in its median home price—which now stands at $230,000.

Youngstown, Ohio, had the third-largest increase in the country, with prices growing by 13.6 percent in the first quarter of the year to reach $161,900. Nassau County on Long Island followed with a 12 percent increase, bringing its median home price to $779,300.

Ohio and New York had three entries each on the list of 10 metros with the biggest home price gains.

Toledo and Cleveland both posted 11 percent increases, bringing their median home prices to $183,900 and $213,200, respectively.

Rochester, New York, also saw an 11 percent year-over-year rise, with its median home price now $235,900.

Gulfport, Mississippi, Trenton, New Jersey, and Allentown, Pennsylvania, rounded out the top 10, with home price increases ranging from 10.2 percent to 10.5 percent.

The NAR report showed that the Northeast recorded the highest price gains by percentage, with a 10.3 percent increase in home prices year over year. The South, on the other hand, had a modest 1.3 percent gain. The Midwest and West posted increases of 5.2 percent and 4.1 percent, respectively.

What People Are Saying

Lawrence Yun, NAR chief economist, said: “Most metro markets continue to set new record highs for home prices. In the first quarter, the Northeast performed best in both sales and price gains by percentage. Despite the stronger job additions, the South lagged with declining sales and virtually no price appreciation.”

Hannah Jones, a senior economic research analyst at Realtor.com, said: “The market continues to see intense competition, which has driven prices higher.”

What Happens Next

Despite rising mortgage rates—hovering between 6 percent and 7 percent—demand remains strong in cities with shrinking inventory and affordable pricing, due in part to the fact that there are many Americans who have long been waiting to get on the property ladder.

With inventory levels at historic lows in key cities, analysts suspects that prices may continue increasing in many cities across the country in the following months.

NAR